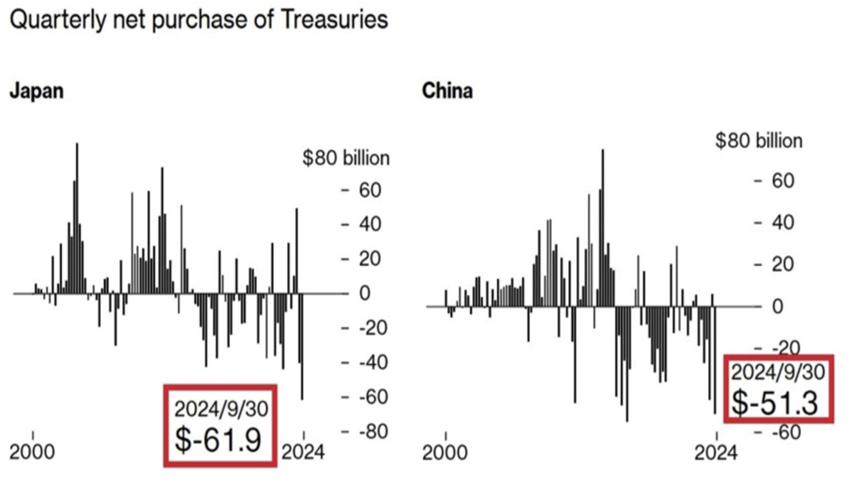

Treasuries

Has the US Treasury market withstood the onslaught of Foreign selling pressure?

Japan and China are dumping US Treasuries: In Q3 2024, Japan sold a net $61.9 billion of Treasuries, the most on record. This was the second consecutive quarter of selling after $40.5 billion in Q2. At the same time, China dumped $51.3 billion, the second largest amount ever recorded. China has now sold Treasuries in 6 out of the last 7 quarters and its total holdings fell below $800 billion for the first time in 16 years. 2 of the world’s biggest foreign holders of US government debt are selling like never before.

If we take a look at Foreign holdings of Treasuries as %, we can see they are down from 55% in 2008 to just under 31% presently. Might it be safe to assume the bulk of selling is over?

Top Panel is % of Foreign Ownership, middle panel is net purchases of China mainland, and bottom panel is net purchases of Japan.

If that selling pressure has abated, might that be one less pressure point on rates?

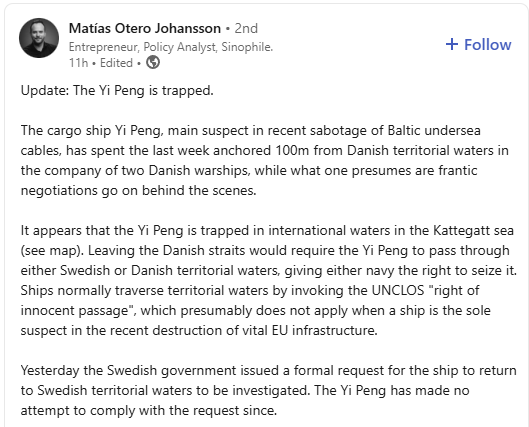

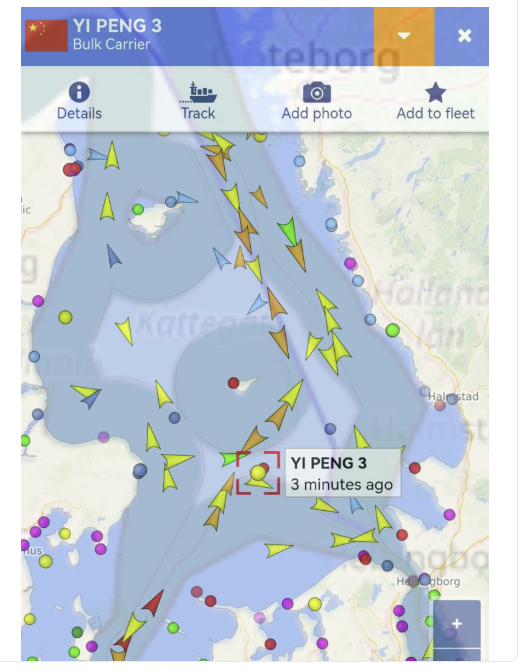

Chinese Fishing Boat and the Kattegatt Sea

A post that caught our eye this week, mostly because we have not seen any other exposure on this event.

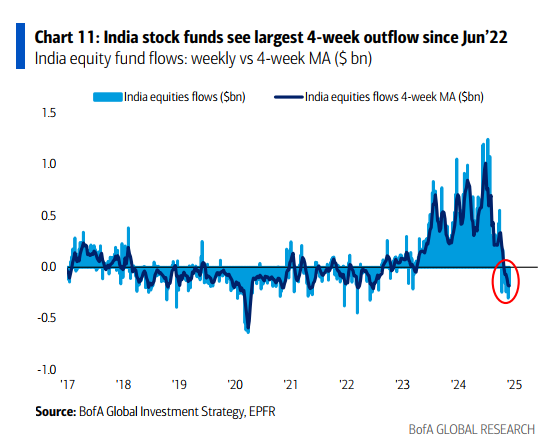

India and Fund Flows

We mention because it appears around this P/E level, is where the NIFTY index has bounced 4 previous times since then.

Bitcoin

No call here on price, but simply pointing out that Open Interest on Bitcoin futures contracts is, not surprisingly, at an all-time high. More institutional focus expressed through the futures market ?

What caught our attention regarding the open interest chart ?

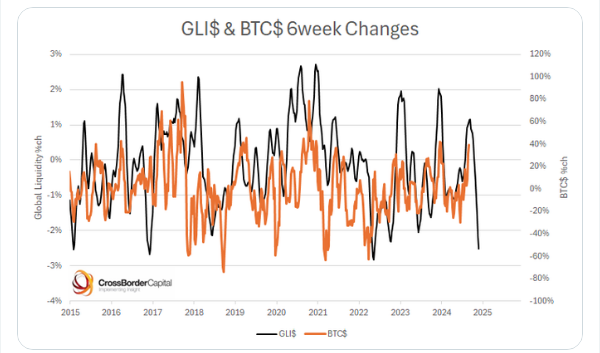

The chart from this post. https://x.com/crossbordercap/status/1861814218971812298

“Here we track our GLI metric (NOT M2!) advanced by 3 months vs the 6w change in Bitcoin back to 2015. May be another buying opportunity ahead?”

Have a great weekend!

Best,

Meraki Trading Team

About Meraki Global Advisors

Meraki Global Advisors is a leading outsourced trading firm that eliminates investment managers’ implicit and explicit deadweight loss resulting from inefficient trading desk architectures. With locations in Park City, UT and Hong Kong, Meraki’s best-in-class traders provide conflict-free 24×6 global trading in every asset class, region, and country to hedge funds and asset managers of all sizes. Meraki Global Advisors LLC is a FINRA member and SEC Registered and Meraki Global Advisors (HK) Ltd is licensed and regulated by the Securities & Futures Commission of Hong Kong.

For more information, visit the Meraki Global Advisors website and LinkedIn page

Contact:

Mary McAvey

VP of Business Development